The moment the Bank of Canada holds or lowers its key lending rate, the first question we get—often in masses—is: “Did my fixed mortgage rate go down, or will it?”

It’s an important question, and the answer isn’t always a simple yes.

Fixed rates follow bond yields, not the Bank of Canada’s overnight rate. That means a central bank move doesn’t necessarily translate into an immediate change in fixed mortgage rates.

Understanding the Current Rate Environment Interest rate headlines can be confusing—especially when central banks cut rates, but fixed mortgage rates don’t follow suit.

Did you KNOW that the Bank of Canada (consumer facing) prime lending rate was 4.95?

This means when the Bank of Canada cut rates by .25 on September 17, 2025– it dropped this (consumer facing) rate to 4.70%. This directly impacts clients with variable/adjustable-rate mortgages and lines of credit.

How a 2.50% Bank of Canada Rate Becomes a 4.70% Prime Rate

The Bank of Canada sets an overnight lending rate—currently 2.50%—which is the base cost for banks to lend money to each other. Consumer loans (like variable-rate mortgages, lines of credit, and many business loans) are priced off a separate number called the prime rate.

Banks typically add about 2.20% on top of the Bank of Canada rate to cover their costs and profit. So:

2.50 % (Bank of Canada overnight rate)

+ 2.20 % (bank spread)

= ≈4.70 % consumer prime rate

That’s why when the Bank of Canada moves its rate up or down, you’ll often see banks adjust their prime by the same amount—keeping that built-in spread.

This quick explanation below is from one of our industry leading economists.

Bruno Valko explains how inflation, bond yields, and key U.S. economic data interact to shape Canadian mortgage rates.

NOTE: When BOND YIELDS move up – historically fixed rates hold or go up.

Whether you’re renewing, buying, or considering a variable/adjustable rate, these insights will help you understand the forces at play so you can make confident mortgage decisions.

Info as of SEPT 22/2025 via Bruno Valko

Bonds Hate Inflation:

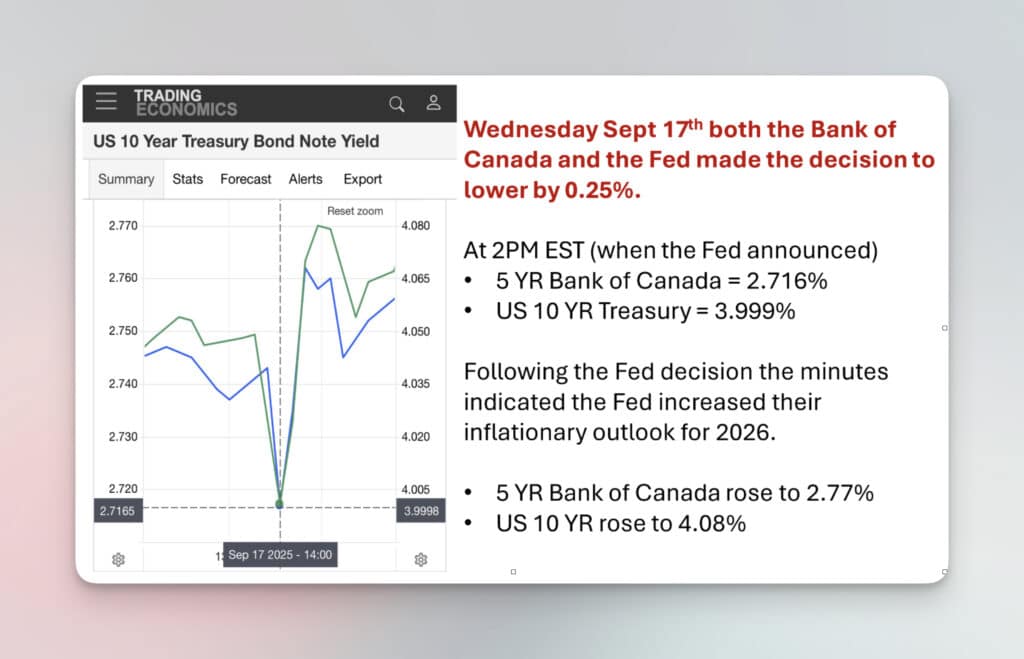

Last week both the Bank of Canada and the Fed lowered their lending rates. This is great news for adjustable-rate mortgages and lines of credit.

So why are bond yields rising? The answer is Inflation.

In their post meeting statement, the Fed announced that Inflation “has moved up and remains somewhat elevated.” Lower job growth and higher inflation are in conflict with the Fed’s twin goals of stable prices and full employment.

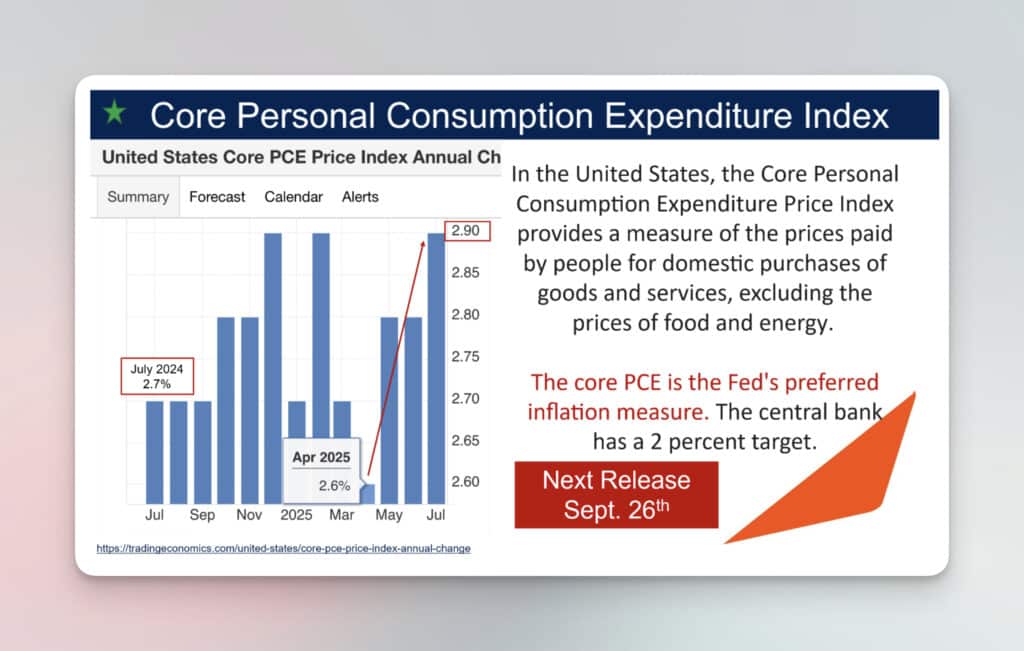

The Fed also increased its outlook on PCE and Core PCE inflation for 2026. The PCE or Personal Consumption Expenditure Index is a preferred gauge the Fed monitors for underlying inflation risk. See details here.

My thoughts:

- Stagflation anyone?

- I hope not, but lower job growth and elevated inflation are signs of it and a future potential threat of it.

Stagflation Risks Linger

U.S. consumer prices increased by the most in seven months in August amid higher costs for housing and food, resulting in the biggest year-on-year increase in inflation since January. Combined with softening labor market conditions, higher inflation has sparked fears of stagflation.

Just because the Fed or the Bank of Canada lowers, doesn’t necessarily mean bond yields will come down and by extension fixed mortgage rates.

The 5 YR Canada Bond Yield being pulled along by the US 10YR Treasury yield again!

I often talk about this and even used the King Kong analogy in the past with King Kong being the United States and the woman he holds hostage and carries to the top of the Empire State Building Canada.

- Canada bond yields rose following the Fed’s minutes and indication of elevated inflation being a risk. See chart below, as usual the two yields typically move in the same trajectory.

- The 10YR US Treasury yield dipped below 4% at one point on Wednesday. But then came the Fed forward guidance and inflationary comments, and Friday, it closed at 4.133%.

- The Fed decreases by 0.25% and the US 10 YR rises by 0.14%. Why? Inflation risks.

What is the PCE and Core PCE?

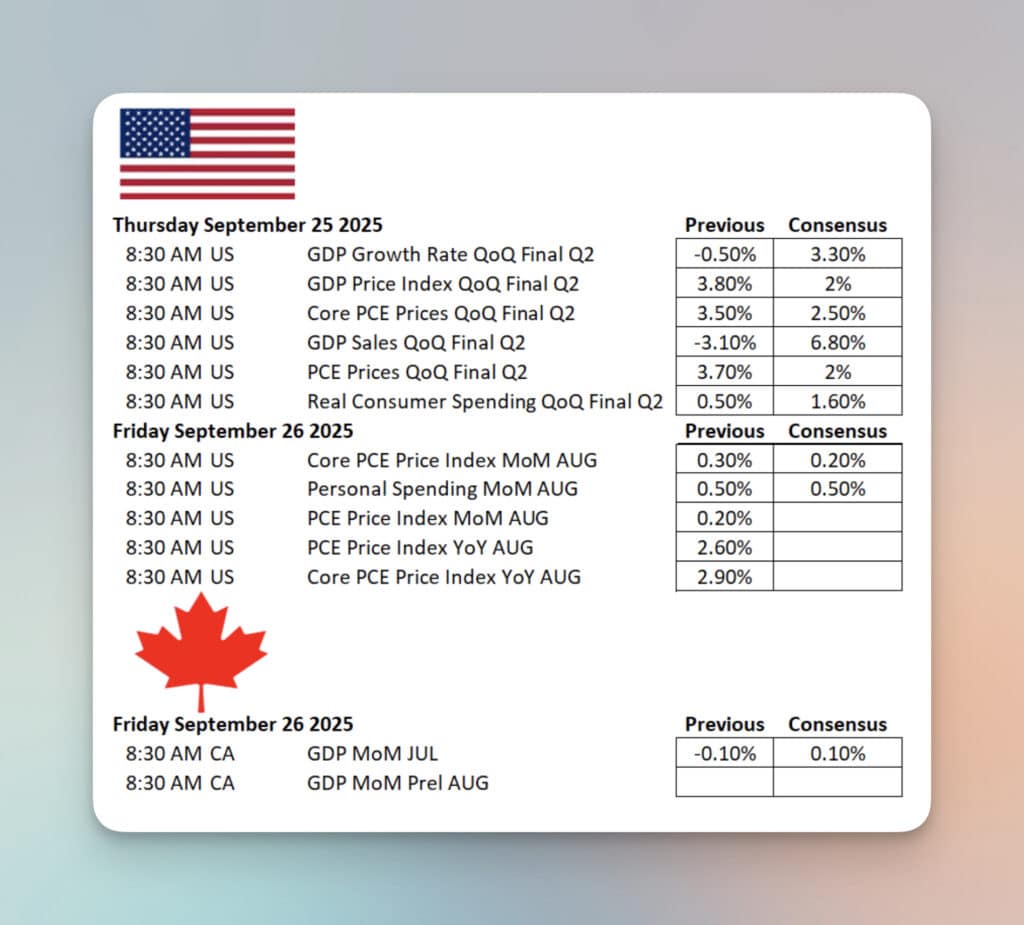

The Week Ahead: Some Important Data Releases that may impact Bond Yields