Are you a first-time homebuyer in Canada dreaming of owning your own place?

The journey to homeownership often begins with saving for that all-important down payment.

There is a new initiative designed to make achieving that goal easier.

The new First-Time Home Buyer Savings Plan (FHSA) is a program tailored to help Canadians save efficiently for their first home.

Combining the power of using the First time Home Buyer RSP program and the new FHSA to save for a downpayment and invest in your new home purchase is a strategic plan of investing into the purchase of your first home.

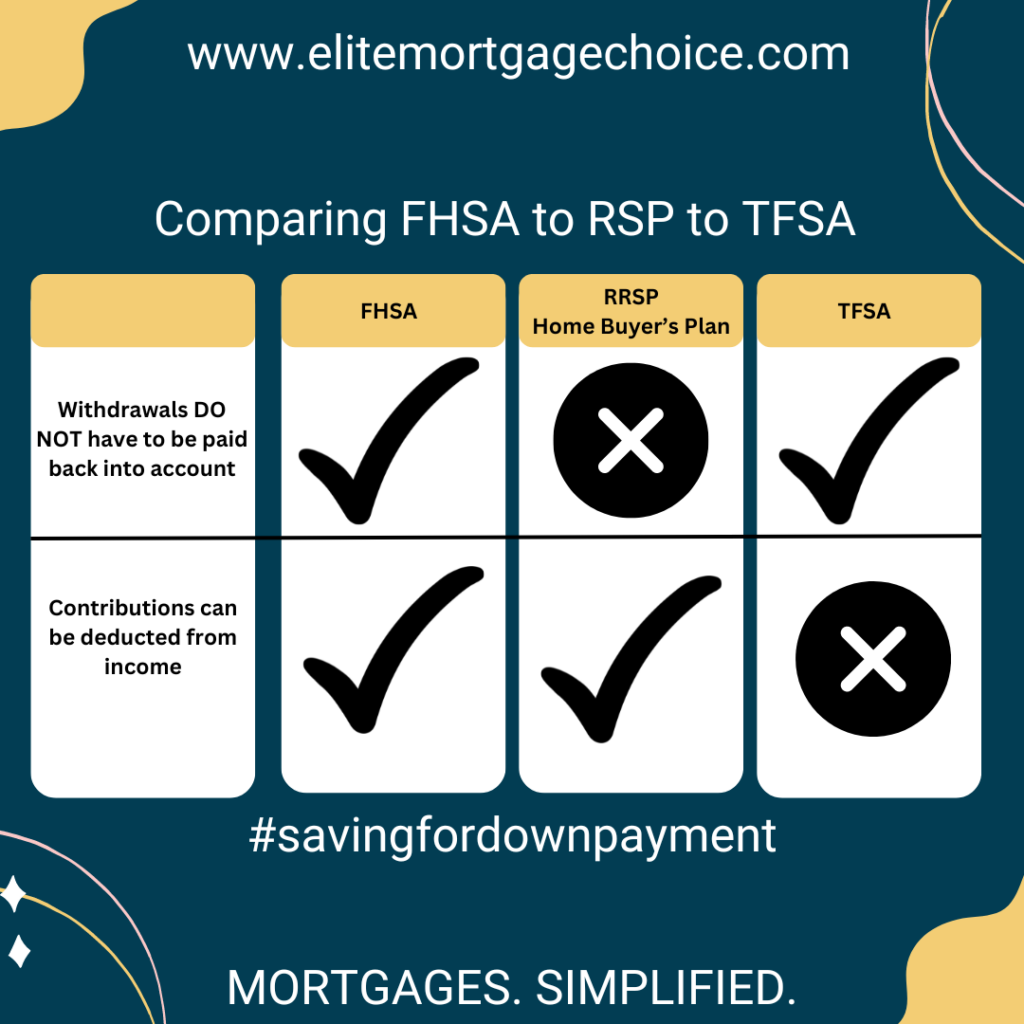

The FHSA is not meant to replace the RSP or TFSA but is an added benefit.

Let’s delve into what this plan entails.

Understanding the FHSA Savings Plan

How Does It Work?

The mechanics of the FTHB Savings Plan are relatively straightforward.

Canadians who qualify as first-time homebuyers can open a dedicated savings account (with your current bank that handles your day-to-day banking) specifically designed for this purpose.

This account allows individuals or couples to deposit funds with the added benefit of tax advantages.

Key Features and Benefits

Tax Benefits:

One of the most attractive aspects of the FTHB Savings Plan is its tax advantages.

- Contributions to the savings account are eligible for tax deductions, reducing your overall tax liability. This means that as you save for your first home, you also benefit from potential tax savings.

- Annual contributions can be deducted when you file your income tax (like an RSP)

Flexible Saving Options: Annual Contribution Limit:

- While RRSP withdrawals under the HBP (Home Buyer plan) are subject to specific withdrawal limits based on individual RRSP balances, the FTHB Savings Plan imposes an annual contribution limit. As of now, the maximum annual contribution to the FTHB Savings Plan is $8,000. (or lifetime limit $40,000)

Interest Earnings:

- Like traditional savings accounts, funds deposited into the FTHB Savings Plan often accrue interest over time. This means that you are saving for your home, and your money is also working for you, generating additional income through interest earnings.

Eligibility Criteria

- While the specifics may vary depending on provincial regulations and government policies, there are general eligibility criteria typically associated with the FTHB Savings Plan:

- Must be a Canadian citizen or permanent resident.

- Must be a first-time homebuyer, defined as someone who has not lived in a home that you or your partner owned in the current calendar year or any of the previous 4 calendar year

- Must intend to use the funds for the purchase of a qualifying home.

Making qualifying withdrawals from your FHSAs

- If you meet all the qualifying withdrawal conditions, you can withdraw all the funds from your FHSAs tax-free. You can do this in a single withdrawal or a series of withdrawals.

- There is no minimum number of days that contributions or transfers to your FHSAs must stay in your FHSAs before you can use them as a qualifying withdrawal.

- You do not need to repay the qualifying withdrawals from your FHSAs.

- If you are buying or building a qualifying home with another individual, you can each make a qualifying withdrawal from your own FHSAs if you both meet all the conditions to make a qualifying withdrawal.

You are responsible for ensuring that all the qualifying withdrawal conditions are met. If you make a qualifying withdrawal and a condition is not met at the time of the withdrawal, your withdrawal will be treated as a taxable withdrawal.

Click here to read more directly on the Government of Canada website.

Let’s compare the (FHSA) to the RSP Home Buyers Plan (HBP)

RRSP Withdrawals: Payback Periods and Limitations

Withdrawing from an RRSP for a first home purchase entails specific conditions and repayment obligations.

Here’s a breakdown of key points:

- Repayment Requirement: Any funds withdrawn from an RRSP under the Home Buyers’ Plan (HBP) must be repaid within a 15-year period. This means that the withdrawn amount needs to be returned to the RRSP gradually over the specified timeframe to maintain the tax-deferred status of the funds.

- No Immediate Withdrawal: While RRSP withdrawals under the HBP offer the advantage of deferring taxes on the withdrawn amount, there’s a waiting period before accessing the funds. Individuals must wait up to 90 days after the initial deposit into the RRSP before being eligible to withdraw funds under the HBP.

Click here to read more directly on the Government of Canada website.

In conclusion, Canada’s new First-Time Home Buyer Savings Plan Account (FHSA) represents a significant step toward realizing many Canadians’ dream of homeownership.

With the FHSA, first-time homebuyers now have a dedicated tool to save efficiently for their inaugural home purchase.

Ultimately, the FHSA presents a promising opportunity for first-time homebuyers in Canada to embark on their homeownership journey with greater financial support and confidence.